NEWSmart templates for every funding scenario

No more founder math panic.

Caprunner makes funding, dilution, and exits simple to understand—before you sign anything.

Caprunner changes how founders raise money.

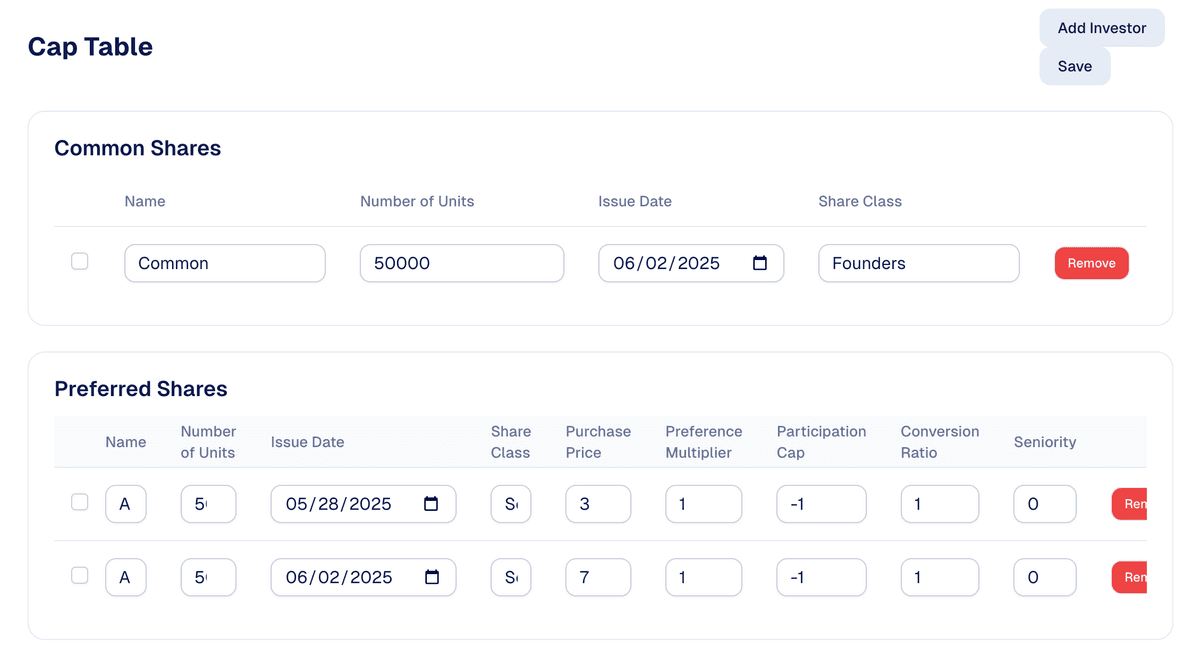

Cap Table

Easily maintain and manage complex cap tables with a platform that teaches you how to do it.

By Round & By Investor

See your term sheets with the big picture of funding rounds and the granularity of each investor.

Simulations & Scenarios

See your projected returns over time, and track your equity.

Navigating Venture Capital Isn't Easy

What is Preferred Stock?

How much will investor Dividends cost me?

What is an Exercise Price?

What's the difference between Pre-Money & Post-Money?

Should I raise SAFEs or shares?

What are SAFEs?

How does Convertible Debt work?

What is Vesting?

At what exit can employees cash in?

Will everyone get paid at this price?

What does Pro Rata mean?

How does Preferred Stock Preference work?

When does my MOIC vesting trigger?

What is Multiple of Invested Capital? ("MOIC")

Does 20% of shares really equal 20% ownership?

When should my debt convert to shares?

Caprunner Is Your Startup's Funding Advisor

Understand your term sheets inside out.

Pricing

Choose the plan that works best for you.

Recommended

Pro

Best for early founders

- Save 1 cap table

- Advanced payout analysis

- Simulate multiple exit scenarios

- Project payouts into the future

$60 / month

Enterprise

Custom plan tailored to your requirements

- Unlimited projects

- Enterprise support